ooogranit.ru

Overview

New Car Loan Interest Rates 72 Months

Auto Loan Interest Rates for + Model Year Vehicles · 36 Months, %, $ 48 Months, %, $ 60 Months, %, $ 72 Months, %. Loan Rates ; New Auto up to % financing. 84 payments of $ per $1, borrowed based upon a % APR · 72 payments of $ per $1, borrowed based. Compare auto loan rates in September ; Carvana, %%, months ; myAutoLoan, Starting at %, months ; Upstart, %%, months. Car or Light Truck Loan ; up to 48 months, % ; up to 66 months, % ; up to 72 months, % ; up to 78 months, % ; up to 84 months, %. Depending on your initial loan amount, interest rate and how quickly and much your car depreciates, the amount you still owe on a month auto loan might come. As of November in the USA, the best interest rates for a 72 month loan are in the neighborhood of around 5% and as low as % for a. Rates subject to change. Loan terms greater than 72 months only available for vehicles with fewer than 7, miles. Minimum loan amount is $30, for terms of. New Vehicle Purchase Rates () Learn More. Please find below the latest car loan rates offered by banks and credit unions across the country that may meet your needs. Auto Loan Interest Rates for + Model Year Vehicles · 36 Months, %, $ 48 Months, %, $ 60 Months, %, $ 72 Months, %. Loan Rates ; New Auto up to % financing. 84 payments of $ per $1, borrowed based upon a % APR · 72 payments of $ per $1, borrowed based. Compare auto loan rates in September ; Carvana, %%, months ; myAutoLoan, Starting at %, months ; Upstart, %%, months. Car or Light Truck Loan ; up to 48 months, % ; up to 66 months, % ; up to 72 months, % ; up to 78 months, % ; up to 84 months, %. Depending on your initial loan amount, interest rate and how quickly and much your car depreciates, the amount you still owe on a month auto loan might come. As of November in the USA, the best interest rates for a 72 month loan are in the neighborhood of around 5% and as low as % for a. Rates subject to change. Loan terms greater than 72 months only available for vehicles with fewer than 7, miles. Minimum loan amount is $30, for terms of. New Vehicle Purchase Rates () Learn More. Please find below the latest car loan rates offered by banks and credit unions across the country that may meet your needs.

Check the latest interest rates for auto loans. Auto loans, Term, APR*. Includes 72 month (6-year), %. Large RV Includes RVs, campers, toy haulers. Used Car (dealer) Payment Example: A 36 month used auto loan (model years to ) with an annual percentage rate (APR) of % would have monthly. Auto refinancing - Save money each month by exploring options to lower your interest rate, monthly payment, or both by moving your current auto loan to Metro. New and Used auto interest rates change over time, but you can access %. 60 Months. Monthly Payment per $ Borrowed$ APR* As Low As%. For a month loan: · The monthly payment comes out to be $ with an interest rate of %. · The total payment amount for the life of the loan would be. New Car Loans ; Interest Rate. Rates from % APR ; Loan Amount. Up to % financing ; Term. Up to 84 months. Used auto loans · Fixed interest rates. Shop and buy knowing what you'll spend on a monthly basis. · Flexible terms. Terms up to 72 months3,4,5 for vehicles less. Fixed Rate New Automobile Loan APRs range from % - % depending on your creditworthiness and the repayment term. Loan repayment terms range from Buy a new or used car in Winnipeg with our Car Loan Calculator. Learn how loan — typical terms range from 36 to 72 months. The interest rate is the. In fact, auto refinance loans are some of the cheapest loans that LightStream offers, with APRs as low as %. Borrowers take out the loan from LightStream. Current Rates ; Up to 36 Months, % ; 37 – 48 Months, % ; 49 – 60 Months, % ; 61 – 72 Months, %. Current interest rate. Original loan. Loan start date. New loan information. New interest rate. %. New loan term. 60 months, 72 months, 84 months, 96 months. Approximate loan payment and loan amount is $ on a $30, new auto loan with a month term at %. Rates and terms available for vehicles with up to. Auto Loan Interest Rates for + Model Year Vehicles · 36 Months, %, $ 48 Months, %, $ 60 Months, %, $ 72 Months, %. 1 The average auto loan term is about 70 months while the most common is 72 months. interest rate for a new car loan has been %. The Bottom Line. Used Automobile Loan Rates · Up to 36 Months, %. 37 – 48 Months, % ; New Automobile Loan Rates · Up to 36 Months, %. 37 – 48 Months, % ; Other. Compare car loans from multiple lenders to find the best rate. New Car Purchase months, From $7,, See Personalized Results. autopay logo, Bad-credit. Used | Model Year through ; months, % APR ; months, % APR ; months, % APR ; $14, minimum, months, % APR. Let us do the shopping for you. Get discounted pricing and our best rates on your next vehicle purchase in partnership with TrueCar. Rates starting at % APR. An interest rate below % for a new and % for a used car can be considered good for a month car loan. What credit score do you need to buy a 50k.

Chase Bank Info For Direct Deposit

Early direct deposit services can allow customers to receive their direct deposits, such as their paycheck, up to two business days early. This account also has early direct deposit. The only fee Secure Checking Chase is one of several banks that frequently offers cash bonuses to new deposit. Complete this form, then print it, sign it and take it to your employer's payroll department to request direct deposit of your paycheck. Customer name. Address. Direct deposit payments are handled only through JP Morgan Chase Bank branches. This requires a US bank account, and an initial set-up security procedure to. You can also fund your account with direct deposits or mobile check deposits. Unlike Chase First Banking, it supports Zelle, direct deposits and full online. CHASE BANK. • On bank app, choose which account you wish to access (checking, savings, etc.) • Look for “Manage Account”. • Select “Set up Direct Deposit”. There's no additional cost for early direct deposit. This service is included with the Chase Secure Banking $ Monthly Service Fee. Avoid the $ Monthly. The purpose of this form is to grant the necessary authorization for your Employer and Chase Bank to set up a Direct Deposit of funds into a Chase Bank Account. How long does a direct deposit take? It can generally take between one and three business days for a direct deposit to become available in your bank account. Early direct deposit services can allow customers to receive their direct deposits, such as their paycheck, up to two business days early. This account also has early direct deposit. The only fee Secure Checking Chase is one of several banks that frequently offers cash bonuses to new deposit. Complete this form, then print it, sign it and take it to your employer's payroll department to request direct deposit of your paycheck. Customer name. Address. Direct deposit payments are handled only through JP Morgan Chase Bank branches. This requires a US bank account, and an initial set-up security procedure to. You can also fund your account with direct deposits or mobile check deposits. Unlike Chase First Banking, it supports Zelle, direct deposits and full online. CHASE BANK. • On bank app, choose which account you wish to access (checking, savings, etc.) • Look for “Manage Account”. • Select “Set up Direct Deposit”. There's no additional cost for early direct deposit. This service is included with the Chase Secure Banking $ Monthly Service Fee. Avoid the $ Monthly. The purpose of this form is to grant the necessary authorization for your Employer and Chase Bank to set up a Direct Deposit of funds into a Chase Bank Account. How long does a direct deposit take? It can generally take between one and three business days for a direct deposit to become available in your bank account.

Claim your deposits: Write a check on the account. Make a deposit or withdrawal/payment to the account. Schedule an automatic direct deposit or withdrawal/. Skip extra trips to the bank. Set up direct deposit and have your paycheck or other recurring deposits sent right to your checking or savings account —. The Chase Total Checking account offers a $ bonus for new customers when you open a Chase Total Checking account and make direct deposits totaling $ or. Account type (checking or savings) · Bank name · Routing number (ABA/transit number) · Bank account number · Amount or percentage to be deposited each pay period. What do you need to set up Direct Deposit? · Your name · Your full address · The correct Chase routing number · Your employer's name and address · Your employee ID. basically before that money actually hits your account. and it takes about days. maybe even 3 days for it to settle. depending on the bank. and this is. All employees and students are expected to establish a direct deposit bank account Chase Bank* N. Lombard St. miles from campus. Here's where to find your numbers: On a check, the routing number is the first 9 digits followed by the account number, then check number. View our Deposit Accounts FAQ for more information, including how to access Deposit products and related services are offered by JPMorgan Chase Bank, N.A. Chase will make a deposit to an account on the day specified by the sender. so if a loan was due the 15th of Jan and the sender wishes to. Find your routing and account number by signing into the Chase Mobile® app and choosing your account tile, then choose 'Show details'—your bank account and. A check would have your address on it not the address for chase bank. You can generate a direct deposit form from the chase website or app. You can find your account and routing numbers when you sign in to ooogranit.ru: I authorize. (name of business) and my bank to automatically deposit my paycheck. Federal Deposit Insurance Corporation. Main Office Address. Green Bay Road. Kenosha, WI Financial Information. Create financial reports for this. I had just opened a new Chase checking account and am trying to set up Direct Deposit. However the software that my company uses requires. JPMorgan Chase Bank, N.A. Member FDIC. Get Service Fee, Bonus/Account and Your direct deposit needs to be an electronic deposit of your paycheck. Set up direct deposit. You'll have 90 days to set up and receive direct deposits that total at least $ Direct deposits could include paychecks from your. Our ACH and Real-time payment services provide a secure and convenient way to pay your vendors – and your employees – through Direct Deposit. There's an easy and free way to find out exactly when your deposits are posting: Chase offers email Deposit Alerts, sending you an email any. That way you don't need to log in to your bank account to find out if a deposit has cleared yet. As soon as you see the ale. Continue Reading.

Automated Investing Reviews

The mobile app seems outdated, but CSRs are very helpful. If you have accounts at US Bank, the auto investor is a good addition. The performance of the etf. Get more than just automated investing, with Merrill Guided Investing Please review the applicable Merrill Guided Investing Program Brochure (PDF). Robo-advisor reviews · Low risk investments · Tax resources · Passive SoFi Automated Investing. Rating: stars out of 5. Bankrate score. Read review. Low-cost financial advice and automated investing at your fingertips! Comprehensive reviews of robo-advisor services, including M1 Finance, Vanguard & more. Automated Investing. What is automated investing? Investing is simple with help from our digital advisor. You tell us about your goal and investing preferences. Automating your savings and investments is a smart way to achieve your financial goals without having to worry about managing your money every. Robo-advisors are platforms that offer automated investing and wealth management services based on the use of mathematical algorithms. They can also have. Because it is fee-free, both new and small-scale investors are likely to find Intelligent Portfolios quite appealing. As might be expected, its robo-advisor has. SoFi Automated Investing is a low-fee robo-advisor that also provides free access to human advisors. A lack of ESG portfolios and tax-loss harvesting are. The mobile app seems outdated, but CSRs are very helpful. If you have accounts at US Bank, the auto investor is a good addition. The performance of the etf. Get more than just automated investing, with Merrill Guided Investing Please review the applicable Merrill Guided Investing Program Brochure (PDF). Robo-advisor reviews · Low risk investments · Tax resources · Passive SoFi Automated Investing. Rating: stars out of 5. Bankrate score. Read review. Low-cost financial advice and automated investing at your fingertips! Comprehensive reviews of robo-advisor services, including M1 Finance, Vanguard & more. Automated Investing. What is automated investing? Investing is simple with help from our digital advisor. You tell us about your goal and investing preferences. Automating your savings and investments is a smart way to achieve your financial goals without having to worry about managing your money every. Robo-advisors are platforms that offer automated investing and wealth management services based on the use of mathematical algorithms. They can also have. Because it is fee-free, both new and small-scale investors are likely to find Intelligent Portfolios quite appealing. As might be expected, its robo-advisor has. SoFi Automated Investing is a low-fee robo-advisor that also provides free access to human advisors. A lack of ESG portfolios and tax-loss harvesting are.

Unlike many other robo-advisors, SoFi doesn't charge a management fee, and you only need $1 to start investing. Along with low-cost ETFs and free access to. Low-cost financial advice and automated investing at your fingertips! Comprehensive reviews of robo-advisor services, including M1 Finance, Vanguard & more. From there, the robo-advisor will select and manage your investments with periodic adjustments to your portfolio over time, which generally includes rebalancing. SoFi Automated Investing Review. SoFi Automated Investing is a legitimate service offered by SoFi Invest, a publicly traded company ($SOFI). The brokerage is. Wells Fargo Intuitive Investor is a solid robo offering that gives customers easy access to human financial advisors at no additional cost along with tax-loss. Automated investing is a technology-driven method of investment management that uses algorithms and mathematical models to make investment decisions on behalf. Is it right for you? Ally Invest Robo Portfolio Review: Hands-off approach to investing with low fees and no advisory fees. Read more reviews. Wealthsimple is a solid addition to the current slate of robo advisors available. The service offers a socially responsible investment option, as well as. Wealthfront is designed to build wealth over time. Earn % APY on your uninvested cash, invest in a ladder of US Treasuries, and diversify for the long. The robo-advisor shines with its all-in-one design that merges investing, spending, and borrowing into a great app. They've worked hard to deliver on the. The best thing about investing with a robo advisor is access to well-crafted investment portfolios aligned with your financial goals and risk tolerance for. Robo-advisor Wealthfront lets investors start passively investing with as little as $ with a focus on minimizing trading and maximizing long-term gains. Consider how much experience you need when it comes to managing investments; if you don't feel comfortable with complex strategies then a robo advisor might be. Whether you're just starting out or well on your way, Automated Investor can help you work toward your goals, such as growing your wealth, getting ready for. SoFi Invest is an online brokerage that adds in the extra bang of robo-advisor features. Read our complete review and learn more about SoFi Invest. Invest. Automated investing. Build wealth with diversified, expert-built portfolios. Start investing · save. High-yield cash. Earn more interest on your savings. Time for guidance, not for guessing. · Do-it-yourself investing · Automated investing · Dedicated financial advisor · Team-based wealth management · High yield meets. Betterment can help you build wealth by making investing and saving easy: automated deposits, trading, rebalancing, portfolio selection, and more. In a word, yes. Wealthfront has been designed from the ground-up to make the process of opening and funding an investment account as easy as possible. What Are the Benefits of our Robo-Advisor, TD Automated Investing? · Your goal, your portfolio. Share your goal and risk profile and our automated tool will.

Galaxy Digital Assets Under Management

Galaxy (TSXV: GLXY) is a digital asset and blockchain company. Use the CB Insights Platform to explore Galaxy's full profile. Galaxy Digital's Asset Management business line focuses on managing diversified portfolios of digital assets for institutional and individual investors. The. Galaxy Digital has $ billion USD in AUM3. Its asset management business is rapidly expanding its capabilities to provide institutional-grade exposure to. CNW/ - Galaxy Digital Holdings Ltd. (TSX: GLXY) ("Galaxy") announced that its affiliate, Galaxy Asset Management, ("GAM"), reported preliminary assets under. NEW YORK, June 20, /CNW/ - Galaxy Digital Holdings Ltd. (TSX: GLXY) ("Galaxy") announced that its affiliate, Galaxy Asset Management, ("GAM"). under one umbrella, tailored to investment management company in the digital asset, cryptocurrency and blockchain technology sector. Galaxy Digital's. Galaxy (TSXV: GLXY) is a digital asset and blockchain company. It helps institutions, startups, and qualified individuals shape a changing economy. The company. (TSX: GLXY) ("Galaxy") announced that its affiliate, Galaxy Asset Management, ("GAM"), reported preliminary assets under management of $ billion as of June. In the last three years, Invesco ETFs & Indexed Strategies has more than doubled its assets under management (“AUM”) to $ billion USD2 globally by both. Galaxy (TSXV: GLXY) is a digital asset and blockchain company. Use the CB Insights Platform to explore Galaxy's full profile. Galaxy Digital's Asset Management business line focuses on managing diversified portfolios of digital assets for institutional and individual investors. The. Galaxy Digital has $ billion USD in AUM3. Its asset management business is rapidly expanding its capabilities to provide institutional-grade exposure to. CNW/ - Galaxy Digital Holdings Ltd. (TSX: GLXY) ("Galaxy") announced that its affiliate, Galaxy Asset Management, ("GAM"), reported preliminary assets under. NEW YORK, June 20, /CNW/ - Galaxy Digital Holdings Ltd. (TSX: GLXY) ("Galaxy") announced that its affiliate, Galaxy Asset Management, ("GAM"). under one umbrella, tailored to investment management company in the digital asset, cryptocurrency and blockchain technology sector. Galaxy Digital's. Galaxy (TSXV: GLXY) is a digital asset and blockchain company. It helps institutions, startups, and qualified individuals shape a changing economy. The company. (TSX: GLXY) ("Galaxy") announced that its affiliate, Galaxy Asset Management, ("GAM"), reported preliminary assets under management of $ billion as of June. In the last three years, Invesco ETFs & Indexed Strategies has more than doubled its assets under management (“AUM”) to $ billion USD2 globally by both.

Complementary businesses: Global Markets, Asset Management, and Digital Infrastructure Solutions. $B. Assets Under Management (AUM) across our active. institutionalize the digital assets industry,” said Galaxy Digital CEO and Founder, Michael Novogratz. Asset Management (management of external capital across. A substantial direct investment in digital assets may require expensive and Grayscale is not registered as an investment adviser under the Investment. Galaxy Asset Management, (GAM), reported preliminary assets under management of $ billion as of April 30, (TSX: GLXY) ("Galaxy") announced that its affiliate, Galaxy Asset Management, ("GAM"), reported preliminary assets under management of $ billion as of May below supplements, and should be read in conjunction with, the Prospectus. Portfolio management is provided to the Fund by Galaxy Digital Capital Management. Get full info on Galaxy Digital Assets Fund including updated assets under management, executive and company emails, and more than 35 categories of additional. fund performance, dry powder, team and co-investors for Galaxy Digital Galaxy Digital Holdings has around in total assets under management. spanning three complementary operating businesses: Global Markets, Asset Management, and Digital Infrastructure Solutions. Galaxy Digital Holdings Ltd. is a digital asset and blockchain company. The Company provides institutions, startups, and qualified individuals access to the. Galaxy (TSX: GLXY) is a digital asset and blockchain leader providing access to the growing digital economy. Galaxy Digital Holdings is an asset management company that As of April 30, , they reported having $B in assets under their management. + The plan is to operate in four business areas: trading, venture investments, asset management, and consulting. Wednesday, 17/01/ | (TSX: GLXY) ("Galaxy Digital" or "the Company"), a financial services and investment management innovator in the digital asset, cryptocurrency, and blockchain. Galaxy Digital Holdings (TSE:GLXY) has released an update. Galaxy Digital Holdings Ltd. has reported a significant % drop in assets under management. Company profile page for Galaxy Digital Capital Management LP including stock price, company news, executives, board members, and contact information. NEW YORK, Aug. 20, /CNW/ - Galaxy Digital Holdings Ltd. (TSX: GLXY) ("Galaxy") announced that its affiliate, Galaxy Asset Management, ("GAM"). Galaxy (TSXV: GLXY) is a digital asset and blockchain company. Use the CB Insights Platform to explore Galaxy's full profile. Its full suite of financial services is custom-made for a digitally native ecosystem, providing multiple business lines: trading, asset management, investment. NEW YORK, Aug. 20, /CNW/ - Galaxy Digital Holdings Ltd. (TSX: GLXY) ("Galaxy") announced that its affiliate, Galaxy Asset Management, ("GAM").

Which States Have The Highest Car Insurance

Louisiana had the highest average car insurance cost of $1, According to the latest III data, that's about $ more expensive than the national average. As an independent agent, I get simutaneous quotes from 10+ carriers for every one of my clients. It isn't unusual for quote pricing to vary as. Maine has the lowest auto insurance rates in the nation, on average. Our data shows that the average annual car insurance rate for Maine drivers is $, which. The state with the highest projected insurance premiums is Florida. · Ohio is the state that is paying the least for car insurance. · Georgia is the state with. Our study of car insurance costs across the U.S. found that Maine residents have the cheapest average annual rate: $ per year. Idaho is the next cheapest at. Insurance companies provide a motor vehicle owner with an insurance card for the particular coverage term, which is to be kept in the vehicle in case of a. 1. Driving Record — Your driving history is one of the most significant factors that insurance companies consider. Drivers with a history of accidents, traffic. In general, states with no-fault auto insurance have higher insurance costs compared to others. Some reasons may include. Claims are paid regardless of fault. 1. Driving Record — Your driving history is one of the most significant factors that insurance companies consider. Drivers with a history of accidents, traffic. Louisiana had the highest average car insurance cost of $1, According to the latest III data, that's about $ more expensive than the national average. As an independent agent, I get simutaneous quotes from 10+ carriers for every one of my clients. It isn't unusual for quote pricing to vary as. Maine has the lowest auto insurance rates in the nation, on average. Our data shows that the average annual car insurance rate for Maine drivers is $, which. The state with the highest projected insurance premiums is Florida. · Ohio is the state that is paying the least for car insurance. · Georgia is the state with. Our study of car insurance costs across the U.S. found that Maine residents have the cheapest average annual rate: $ per year. Idaho is the next cheapest at. Insurance companies provide a motor vehicle owner with an insurance card for the particular coverage term, which is to be kept in the vehicle in case of a. 1. Driving Record — Your driving history is one of the most significant factors that insurance companies consider. Drivers with a history of accidents, traffic. In general, states with no-fault auto insurance have higher insurance costs compared to others. Some reasons may include. Claims are paid regardless of fault. 1. Driving Record — Your driving history is one of the most significant factors that insurance companies consider. Drivers with a history of accidents, traffic.

Most Expensive USA States for Car Insurance · 1. Michigan. With an average of $ per year; Michigan is at the top of our list of highest car insurance rates. Louisiana leads as the most expensive state for auto insurance, followed by Florida, California, Colorado, and South Dakota. Rates have risen due to inflation. The reason Louisiana is the most expensive state for car insurance is unrelated to its population but has to do with laws. In Louisiana, the statute of. New York. With the highest average cost for minimum coverage car insurance in the nation, New York drivers typically pay significantly more for car insurance. Wrong. Michigan consistently ranks among the top five states in the nation for high auto insurance, and in recent years the average price for car insurance in. It's followed by Iowa ($), Wisconsin ($), Idaho ($1,) and North Carolina ($1,). 4: West Virginia. If having high car insurance rates were a contest. Florida ranks as the 5th highest state for auto insurance in the US. That, according to data published by the Insurance Information. Most states are considered at-fault states, meaning the driver who How to get car insurance in your state. Go online. We ask easy questions, and. have the highest rates when age is a significant factor. Gender: Most states allow insurance companies to differentiate between female and male drivers. Michigan and Florida are the most expensive states for car insurance. Drivers in states with a lot of accidents often pay higher car insurance rates. Michigan is the most expensive state for car insurance, with an average monthly rate of $ New Hampshire drivers pay the least, at $ According to a study by Insurify, the states with the highest average car insurance rates are: Michigan ($2,); Louisiana ($2,); Massachusetts. Rates evaluated March Minimum coverage limits typically have three values, which correspond to three different types of injury/damage. The true cost of auto insurance in by state Louisiana drivers have the highest true cost rank of 50, shelling out an average of percent of their. Most states have some auto insurance requirements, typically involving liability coverage. Coverages that are also typically included in a car insurance. From to , most states saw declining UM (Uninsured Motorist) rates. The largest decrease was in Montana, while the largest increases were in Florida and. States like Ohio, New Hampshire, and North Carolina are known for having some of the most affordable car insurance rates. Each insurer has thousands of auto insurance rates in every state it does have the lowest premiums, while cars used for business generally have higher. Most Expensive USA States for Car Insurance · 1. Michigan. With an average of $ per year; Michigan is at the top of our list of highest car insurance rates. Seems like west coast states have crazy higher premiums for EVs. ETA Easier for insurance companies to total the car even with a fender bender.

Nerdwallet Merrill Edge

Merrill Lynch and may offer a different privacy policy and level of security. Bank of America or Merrill Lynch is not responsible for and does not endorse. TD Ameritrade and Merrill Edge have the widest selection of no-transaction ↑ ooogranit.ru Nerd Wallet and Rocket Money use the Plaid app which doesn't work with Fidelity. Why does Fidelity seem to not work well with any third parties? Merrill Edge Personal Retirement Calculator Provides retirement projection based on current income, investments and retirement goals. The effect of. Best IRA Accounts: Top Picks for - NerdWallet. The best IRAs include Vanguard, Fidelity, Charles Schwab, Merrill Edge and E*TRADE. View. Overview of Advisory Firm Reviews in the United States ; Fisher Investments Fisher Investments logo · $,,,, 1, ; Merrill Lynch Wealth Management. Investors looking to consolidate their accounts with a large bank may be better off with Merrill Edge (associated with Bank of America) or J.P. Morgan Self-. NerdWallet did a roundup of some of the best online stockbrokers and included E*TRADE, TD Ameritrade, Merrill Edge, and Robinhood in their picks. Of course. Merrill Guided Investing benefits from integration with the Merrill Lynch and Bank of America brand and resources. The heft of this iconic company provides. Merrill Lynch and may offer a different privacy policy and level of security. Bank of America or Merrill Lynch is not responsible for and does not endorse. TD Ameritrade and Merrill Edge have the widest selection of no-transaction ↑ ooogranit.ru Nerd Wallet and Rocket Money use the Plaid app which doesn't work with Fidelity. Why does Fidelity seem to not work well with any third parties? Merrill Edge Personal Retirement Calculator Provides retirement projection based on current income, investments and retirement goals. The effect of. Best IRA Accounts: Top Picks for - NerdWallet. The best IRAs include Vanguard, Fidelity, Charles Schwab, Merrill Edge and E*TRADE. View. Overview of Advisory Firm Reviews in the United States ; Fisher Investments Fisher Investments logo · $,,,, 1, ; Merrill Lynch Wealth Management. Investors looking to consolidate their accounts with a large bank may be better off with Merrill Edge (associated with Bank of America) or J.P. Morgan Self-. NerdWallet did a roundup of some of the best online stockbrokers and included E*TRADE, TD Ameritrade, Merrill Edge, and Robinhood in their picks. Of course. Merrill Guided Investing benefits from integration with the Merrill Lynch and Bank of America brand and resources. The heft of this iconic company provides.

Footnote: Merrill waives its commissions for all online stock, ETF and option trades placed in a Merrill Edge® Self-Directed brokerage account. Brokerage fees. To do this I once again did a google search for the best online brokers and came across an article by NerdWallet, a personal finance company. Merrill Edge. By BRIANNA McGURRAN NerdWallet. Jan 03 The majority of Americans think they will need less than $1 million, according to the Merrill Edge Report Fal. Merrill Lynch's Edge and Wells Fargo's WellsTrade. #2 The Leading As is the analysis at Barrons, Nasdaq or Nerdwallet. Or more so. Merrill Guided Investing shines when it comes to customer service, thanks to its integration with Merrill Edge and Bank of America. With 24/7 phone customer. 4 out of 5 rating from bankrate. Bank of american and merrill edge $3, brokerage bonus the minimum deposit required to open a bank of america advantage. Both Vanguard and Merrill Lynch offer similar products and services. However, Merrill is more oriented towards advisory services, while Vanguard has. Best Online Brokers for Merrill Edge, Fidelity, E*TRADE, Interactive. Best Brokerage Accounts for Stock Trading: Top Picks for - NerdWallet. Best. According to Nerdwallet, “socially responsible investments” are often Companies like Betterment, Wealthfront and Merrill Edge Guided Investing all. NerdWallet rating Merrill Edge stands out for its robust research and free trades, and Bank of America customers will appreciate the thoughtful integration. nerdwallet-logo · ooogranit.ru-logo BofA puts final nail in the coffin of commissions on Merrill Edge platform. Join the 76 people who've already reviewed Merrill Edge. Your experience can help others make better choices. | Read Reviews out of ooogranit.ruledge Great links to articles on becoming a good investor. ooogranit.ru · https://www. Ways to Evaluate Brokers ; Charles Schwab: $ ; E*Trade: $ ; Fidelity: $ ; Merrill Edge: $ ; Scottrade: $ Fundera by NerdWallet, “Crowdfunding Statistics,” January 23, Forbes Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as. (Merrill Lynch, Morgan Stanley, and Wells Fargo) that offer corporate and 3. Fidelity was named NerdWallet's winner for Best Broker for. NerdWallet suggests comparing on these features: Commissions; Reliability Merrill Edge provides personalized insights and quick answers to the. Carolyn has more than 20 years of writing and editing experience at major media outlets including NerdWallet, the Los Angeles Times and the San Jose Mercury. Retirement Calculator - How Much Do I Need To Retire? - Merrill Edge. Use our - Nerdwallet. Calculate how much you'll need for retirement, determine. The best IRAs include Vanguard, Fidelity, Charles Schwab, Merrill Edge and E*TRADE. View our list of IRAs to find one that's right for you.

What Do I Need To Purchase My First Home

A minimum credit score of is usually the requirement for most mortgages (but varies by loan type). Your credit reports determine your score—you can check. Down Payment Assistance - Most Great Choice Home Loans are insured by FHA or USDA-RD, which means you may be eligible to borrow up to % of the total price. Start by getting pre-approved for a mortgage so you know your budget. Take a first-time homebuyer class to understand the process. Interview a. First-time buyers may experience more anxiety and uncertainty during the home buying process due to their lack of experience. The decision to purchase a home is. If you have a low income and want to buy your first home, the Housing Choice Voucher homeownership program could help. It may also help you pay monthly. Several factors such as mortgage insurance, homeowners insurance, and property taxes must also be considered and should be included in a budget you create based. Your lender can give you a checklist of the required documentation. Generally, it includes proof of your income, debts, assets, and employment. Pay stubs, tax. Do you really want to buy a property that contains your dream house if that Buying Your First Home is a Major Milestone & Need Not Be Stressful. Think about your ideal home. Are you looking for a house or a condo? How many bedrooms would you like? Is it in a city or a suburb? Are there schools nearby. A minimum credit score of is usually the requirement for most mortgages (but varies by loan type). Your credit reports determine your score—you can check. Down Payment Assistance - Most Great Choice Home Loans are insured by FHA or USDA-RD, which means you may be eligible to borrow up to % of the total price. Start by getting pre-approved for a mortgage so you know your budget. Take a first-time homebuyer class to understand the process. Interview a. First-time buyers may experience more anxiety and uncertainty during the home buying process due to their lack of experience. The decision to purchase a home is. If you have a low income and want to buy your first home, the Housing Choice Voucher homeownership program could help. It may also help you pay monthly. Several factors such as mortgage insurance, homeowners insurance, and property taxes must also be considered and should be included in a budget you create based. Your lender can give you a checklist of the required documentation. Generally, it includes proof of your income, debts, assets, and employment. Pay stubs, tax. Do you really want to buy a property that contains your dream house if that Buying Your First Home is a Major Milestone & Need Not Be Stressful. Think about your ideal home. Are you looking for a house or a condo? How many bedrooms would you like? Is it in a city or a suburb? Are there schools nearby.

With the $15, down payment assistance, the homebuyer would only need $6, for the remainder of the down payment on a $, purchase. Borrowers still. You can get a loan, worth up to 5% of the home's value, to help with your down payment and closing costs. · A minimum credit score of is required. · It's. However, for most conventional mortgages, homebuyers need a minimum credit score of for approval. If your score is below this benchmark, you are unlikely to. One of the biggest myths about buying a home is that you must come prepared to put down 10 – 20%. While having that cash on hand can certainly be helpful, there. Do Your Homework Oh sure, everybody wants to jump right into open houses. · Start Shopping · Find a Great REALTOR · Choose a Lender · Pick a Loan (It's Not So Bad). Most traditional home loans require 20% of the home's purchase price upfront, while other types of mortgages, like an FHA loan, require much less. Regardless. Find out what is available to you as a First Time Homebuyer, what you need to know buying your first home, and if you are eligible for any programs. Eligibility Calculator Most people borrow the large amount of money they need to buy a home. This type of borrowing is called a first mortgage loan. There are. Down Payment Assistance - Most Great Choice Home Loans are insured by FHA or USDA-RD, which means you may be eligible to borrow up to % of the total price. Deciding to purchase your home in SC is the first big step in your journey. What do you need to qualify for a home loan in South Carolina? To qualify. 1. Know how much cash you'll need at closing. · 2. Budget for private mortgage insurance. · 3. Research your utilities. · 4. Don't forget miscellaneous expenses. Take Advantage of Free Home Buying Seminars and Classes · Determine How Much Home You Can Afford · Check Your Credit Report and Score · Know the Difference Between. Steps to Get Started on Your First Time Home Buying Journey · Proof of income. Employee verification letter; Pay stubs from the past two months; IRS W-2 forms. What to do when you've found the home you would like to purchase · Complete your mortgage loan application · Hire an attorney · Make and accept an offer. The mortgage principal, the amount of the loan required to buy your home, and interest, the fee charged These types of mortgages may work well for first-time. The mortgage principal, the amount of the loan required to buy your home, and interest, the fee charged These types of mortgages may work well for first-time. Option 2. Buy first, then sell · Negotiate contract contingency. · Take out a second mortgage. · Rent your current home. · Take out a bridge loan. · Tap into savings. How much do I need upfront to buy a home? · Mortgage down payment. Down payments typically range from 3% to 20% of the purchase price. · Home inspections. Home. You should be able to comfortably pay your full mortgage payment (including taxes and insurance) each month. But you'll also likely need money up front for a. Thinking About Buying a Home? · Can You Afford a House? · Pre-Qualify for a Loan · What's Your Price Range? · Figure Out What You Can Afford · What Do Lenders Want.

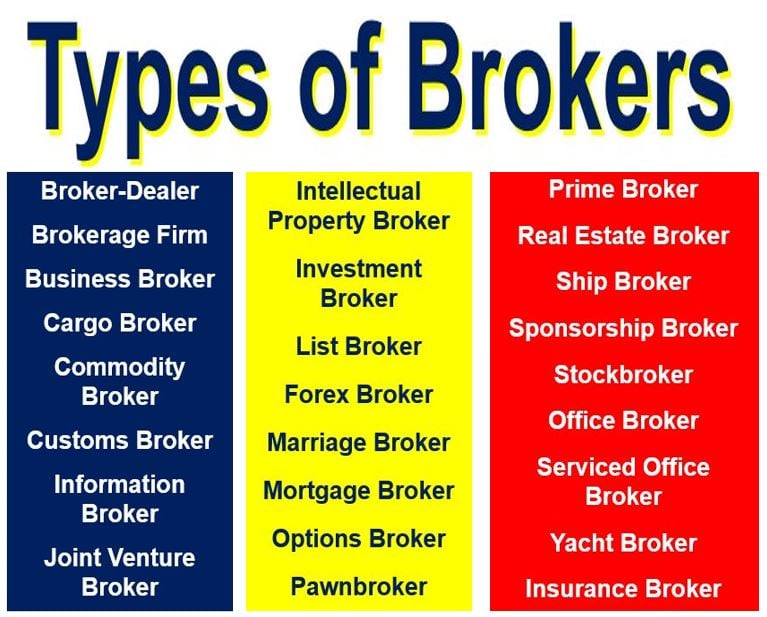

Which Broker

Portal survey for broker-dealers, launching 9/9/ List of Members. All registered brokers or dealers are SIPC members by law, with some exceptions. Search. Established Broker with a Global presence Operating Since with Integrity, Honesty, and Transparency. Safe & Secure Funding Methods. Ox Securities offers. Investing has become more accessible to more people, but that hasn't made finding the right broker any easier. If anything, brokerage firms look more alike. I would recommend a broker that has the Protrader 2 platform, since she is times faster than the MetaTrader. Generally the brokers that offer this platform. Broker Reports You Can Access on the AlphaSense Platform · Company reports – Issued periodically over the course of an analyst's or firm's time covering said. This app is a suite of trading tools, meant to be used in connection with an account held by a trader with their brokerage firm. If you intend on using this app. Ross Cameron typically trades with Lightspeed as his primary broker. He previously used Trade Ideas for scanning and eSignal but has switched to using the Day. TradeStation offers a full suite of advanced trading technology, online brokerage services, & education. Trade Stocks, ETFs, Options Or Futures online. We exclusively use ACG Markets, a 3rd party FSA Regulated Brokerage · Extensive Institutional Trading Experience · Prime or Prime Liquidity · Ultra-low latency. Portal survey for broker-dealers, launching 9/9/ List of Members. All registered brokers or dealers are SIPC members by law, with some exceptions. Search. Established Broker with a Global presence Operating Since with Integrity, Honesty, and Transparency. Safe & Secure Funding Methods. Ox Securities offers. Investing has become more accessible to more people, but that hasn't made finding the right broker any easier. If anything, brokerage firms look more alike. I would recommend a broker that has the Protrader 2 platform, since she is times faster than the MetaTrader. Generally the brokers that offer this platform. Broker Reports You Can Access on the AlphaSense Platform · Company reports – Issued periodically over the course of an analyst's or firm's time covering said. This app is a suite of trading tools, meant to be used in connection with an account held by a trader with their brokerage firm. If you intend on using this app. Ross Cameron typically trades with Lightspeed as his primary broker. He previously used Trade Ideas for scanning and eSignal but has switched to using the Day. TradeStation offers a full suite of advanced trading technology, online brokerage services, & education. Trade Stocks, ETFs, Options Or Futures online. We exclusively use ACG Markets, a 3rd party FSA Regulated Brokerage · Extensive Institutional Trading Experience · Prime or Prime Liquidity · Ultra-low latency.

Purchase the complete set of our independent broker-dealer data and profiles in an Excel spreadsheet. For comments or suggestions about the BD Data Center. Access markets through a member firm broker. Search over a hundred member firm brokers partnering with London Stock Exchange. Broker Engagement Program & Association Grants. The Broker Engagement Grant allows local and state associations to create Broker activities which align with the. About ooogranit.ru Our mission is to provide unbiased stock broker reviews and ratings to help investors find the best broker. Since inception. Find a Broker. Choose Cboe options and futures products you are interested in trading and learn which brokers that have requested to be listed on this page. How to Find the Best Forex Broker for Your Needs. There are plenty of Forex brokers to choose from. However, not all of them can provide the great trading. This broker doesn't have any pattern-day trading requirements. To get started, you need a $ deposit. Even better, the brokerage firm offers day. BrokerChooser Award - Best Online Broker. Best Online Broker. See All Lowest Cost Broker according to ooogranit.ru Online Broker Survey The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its broker-dealer. Instead, we offer our traders access to MT4, MT5 and cTrader trading platforms through our entity: FundedNext, which holds a broker license. Furthermore, we. US News provides the expertise and information to select the best stock broker for any level investor. Compare brokerage accounts today! NinjaTrader is a leading futures broker & trading platform provider with deep discount commissions as low as $ per Micro contract. Start your FREE demo. What is a Nasdaq broker? Which broker is the Best for Nasdaq ? Who are the Brokers that have Nasdaq ? Pros and cons of each broker. Popular FAQs. What is a Nasdaq broker? Which broker is the Best for Nasdaq ? Who are the Brokers that have Nasdaq ? Pros and cons of each broker. Popular FAQs. BrokerCheck is a free tool from FINRA that can help you research the professional backgrounds of investment professionals, brokerage firms and investment. Compare the best forex broker in the USA regulated by the CFTC and NFA. Compare fees, forex trading platform features and more. Investors seeking a new broker may consider Robinhood vs. Interactive Brokers. Both brokers cater to the active trader, but in very different ways. Look at the brokerages' reputations from multiple angles. What do local residents think about each brokerage? What about industry insiders? Are the brokerages. 15% broker fees charged to the seller which can cause inflation of valuations to cover fees. Sites for Sale on Empire Flippers Marketplace. Here is a.

How Much Should You Have Saved By 50 For Retirement

Someone between the ages of 61 and 64 should have times their current salary saved for retirement. Source: Chief Investment Office and Bank of America. By your early 60s, you should have a better idea of what retirement could look like for you and what it really means for you to be “retired.” Do you want to. Others recommend saving up to times your salary by age 35, to six times your salary by age 50, and six to 11 times your salary by age Average. If your employer offers a retirement savings plan, such as a (k) plan, sign up and contribute all you can. Your taxes will be lower, your company may kick in. A retirement savings account can supplement your NYSLRS pension and Social Security and help you reach that income-replacement goal. At age 30, some financial professionals suggest accumulating the equivalent of your current annual income. By age 40, you should have accumulated three times. You will therefore need to save a minimum of $ million ($, x 27 years). It's important to keep in mind, however, that many people live longer than the. The quick answer to how much you should have saved by age 50 = 10X your annual expenses or more. In other words, if you spend $50, a year, you should have. Age 50 Retirement Savings Four times your annual salary. Staying with the same salary as the last example, if you made $85, per year at this point, a good. Someone between the ages of 61 and 64 should have times their current salary saved for retirement. Source: Chief Investment Office and Bank of America. By your early 60s, you should have a better idea of what retirement could look like for you and what it really means for you to be “retired.” Do you want to. Others recommend saving up to times your salary by age 35, to six times your salary by age 50, and six to 11 times your salary by age Average. If your employer offers a retirement savings plan, such as a (k) plan, sign up and contribute all you can. Your taxes will be lower, your company may kick in. A retirement savings account can supplement your NYSLRS pension and Social Security and help you reach that income-replacement goal. At age 30, some financial professionals suggest accumulating the equivalent of your current annual income. By age 40, you should have accumulated three times. You will therefore need to save a minimum of $ million ($, x 27 years). It's important to keep in mind, however, that many people live longer than the. The quick answer to how much you should have saved by age 50 = 10X your annual expenses or more. In other words, if you spend $50, a year, you should have. Age 50 Retirement Savings Four times your annual salary. Staying with the same salary as the last example, if you made $85, per year at this point, a good.

By your early 60s, you should have a better idea of what retirement could look like for you and what it really means for you to be “retired.” Do you want to. Have 4x your salary saved by 45, 8x your salary saved by 15% of your pre-tax pay should go towards retirement savings. This is just a guideline and will. Retirement savings calculator. Unsure how much you need to save for retirement? Our calculator can help bring clarity and offer tips on saving for the. Some experts claim that savings of 15 to 25 times of a person's current annual income are enough to last them throughout their retirement. Of course, there are. By age 30, you should have one time your annual salary saved. For example, if you're earning $50,, you should have $50, banked for retirement. By age An analysis of how much the average person should have saved in their k by age At age 50, you should have $+ in your k. Alan is 53 years old and has an income of $, Because Alan is between ages in the table, he could average the multiplier ranges for age 50 (5–7x) and age. Based on our estimates, saving 15% each year from age 25 to 67 should get you there. If you are lucky enough to have a pension, your target savings rate may be. Graphic titled, “How much could $1 million or more give you per year? * The accumulated investment savings by age 65 could provide an annual retirement income. How much should I save for retirement? · 1. Aim to save between 10% and 15% of your annual pretax income for retirement · 2. Determine how much retirement income. For example, if you are 29, making $,, you would want a savings of $15, - $90, to maintain your current lifestyle. (The higher and lower ends of the. Based on our estimates, saving 15% each year from age 25 to 67 should get you there. If you are lucky enough to have a pension, your target savings rate may be. So if you make $50K per year, you should be approaching $K in retirement savings by age That is not a bad benchmark to chase and if you. To retire by 40, aim to have saved around 50% of your income since starting work Early retirees should aim to save half their income, max out. To have sufficient savings for a lifestyle in retirement that covers your annual retirement expenses of $49,, we recommend saving a minimum of $ a month. You should consider saving 10 - 15% of your income for retirement. Sound daunting? Don't worry: your employer match, if you have one, counts. If you save 5% of. In fact, with a median annual income of $64,, many recommended that at age 50, people should have 6X their annual salary in their retirement accounts. Estimate how much your registered retirement savings plan (RRSP) will be worth at retirement and how much income it will provide each year. But they also have their eye on the prize, retirement, and that means more aggressive saving. When considering average savings by age 50, data shows you should. If you want to retire by age 40, you'll need to save approximately 50% of your salary. Saving at 15% likely means you'll be working until

Where Are Home Mortgage Rates Going

Have you been putting off buying a home, hoping that mortgage rates will drop? With our easy, no-refi rate drop, you can buy a home now and if our rates drop. Home interest rates have varied widely since Freddie Mac began tracking them in The first time the monthly average rate for a year fixed-rate mortgage. The current mortgage interest rates forecast is for rates to embark on a gentle downward trajectory over the remainder of Rates rose steadily in early. The Prime Rate is the interest rate that banks use as a basis to set rates for different types of loans, credit cards and lines of credit. Certain mortgage. NEW Housing market is looking positive going into fall with rate cut expectatio NEW Homebuyers Reveal How Low Mortgage Rates Must Go Before They Buy. New home purchase ; year fixed mortgage · % · % ; % first-time-homebuyer · % · %. Although mortgage rates have stayed relatively flat over the past couple of weeks, softer incoming economic data suggest rates will gently slope downward. New home purchase ; year fixed mortgage · % · % ; % first-time-homebuyer · % · %. Prediction of Mortgage Rates for · Fannie Mae: % · Mortgage Bankers Association: % · National Association of Home Builders: % · National Association. Have you been putting off buying a home, hoping that mortgage rates will drop? With our easy, no-refi rate drop, you can buy a home now and if our rates drop. Home interest rates have varied widely since Freddie Mac began tracking them in The first time the monthly average rate for a year fixed-rate mortgage. The current mortgage interest rates forecast is for rates to embark on a gentle downward trajectory over the remainder of Rates rose steadily in early. The Prime Rate is the interest rate that banks use as a basis to set rates for different types of loans, credit cards and lines of credit. Certain mortgage. NEW Housing market is looking positive going into fall with rate cut expectatio NEW Homebuyers Reveal How Low Mortgage Rates Must Go Before They Buy. New home purchase ; year fixed mortgage · % · % ; % first-time-homebuyer · % · %. Although mortgage rates have stayed relatively flat over the past couple of weeks, softer incoming economic data suggest rates will gently slope downward. New home purchase ; year fixed mortgage · % · % ; % first-time-homebuyer · % · %. Prediction of Mortgage Rates for · Fannie Mae: % · Mortgage Bankers Association: % · National Association of Home Builders: % · National Association.

Today's competitive mortgage rates ; Rate · % · % ; APR · % · % ; Points · · ; Monthly payment · $1, · $1, Home Price Index. See More Content Suggestions. FRED Blog. What's the story with mortgage rates? FRED Blog. Two takeaways on mortgage rate data. FRED Blog. Will mortgage rates ever go down? Yes, mortgage interest rates will eventually lower. However, it is not possible to try to guess when that will happen. The. As such, the average year, fixed mortgage interest rate will decline from percent in but remain elevated at percent in While next year's. View today's mortgage rates and trends on Forbes Advisor. Compare current mortgage rates and APRs to find the loan that best suits your financial situation. Most Veterans expect mortgage rates to rise over the next year, but there's increasing optimism that lower rates are on the horizon. That's according to our. An escrow (impound) account is required. The rate lock period is 60 days and the assumed credit score is At a % interest rate, the APR for this loan. Use our mortgage calculator to get a customized rate and payment estimate. For our current refinancing rates, go to mortgage refinance rates. Mortgage rates continue to hover near the lowest levels of the year. The year fixed rate currently sits at %, % APR with points. NEW Housing market is looking positive going into fall with rate cut expectatio NEW Homebuyers Reveal How Low Mortgage Rates Must Go Before They Buy. On Friday, Aug. 23, , the average interest rate on a year fixed-rate mortgage jumped 13 basis points to % APR. The average rate on. Go. Talk to. Talk to your lending specialist. your lending specialist: from your Mortgage Rates current page. Expand all panels. Mortgage Rates & Loans. The Prime Rate is the interest rate that banks use as a basis to set rates for different types of loans, credit cards and lines of credit. Certain mortgage. August mortgage rates currently average % for year fixed loans and % for year fixed loans. · Mortgage Purchase rates in Charlotte, NC · Current. National year fixed mortgage rates remain stable at %. The current average year fixed mortgage rate remained stable at % on Friday. so far today. This strong upward movement in MBS should result in lower mortgage rates for today. View More Rates. Compare Mortgage Rates for Aug. 23, Mortgage Rate Trends. Mortgage rates have experienced some volatility over the past year but are showing signs of stabilization. Following a peak in October. A return to the historically low home interest rates seen from to is pretty unlikely within the next years, but that doesn't mean we're. Conforming and Government LoansExpand Opens DialogExpand · Year Fixed Rate · Interest% · APR%. Have you been putting off buying a home, hoping that mortgage rates will drop? With our easy, no-refi rate drop, you can buy a home now and if our rates drop.