ooogranit.ru

Learn

Best New Midsize Car

Compare the best medium-size cars ; 1. Dacia Jogger · Dacia Jogger review · New Dacia Jogger ; 2. Volkswagen Golf · Volkswagen Golf review · New Volkswagen Golf ; 3. Explore the best midsize Sedans by vehicle ratings, and dive deeper with the specifics and other customizable filters. What are the top 3 vehicles among best midsize cars? The Honda Accord, Toyota Camry, and Toyota Camry Hybrid are the highest-rated models on. What are the top 3 vehicles among best midsize cars? The Honda Accord, Toyota Camry, and Toyota Camry Hybrid are the highest-rated models on. For long term reliability and low cost maintenance, look at Lexus, Toyota, Mazda, and Honda. Of you can't find a great car among those, you. The Top 10 Most Reliable Midsize Car Models · 1. Honda Accord. Annual Repair Cost. $ Annual Repair Cost · 2. Mitsubishi Galant. $ · 3. Toyota Camry. $ · 4. The current favorite is the Mazda6 Carbon Edition. It's a gorgeous car, reasonably priced, a good size for us, and pretty sporty. The Camry has a reputation for being considered a good family car, but it is still always welcome to have been declared the best. Valley Hi Toyota is proud. Explore the best midsize Sedans by vehicle ratings, and dive deeper with the specifics and other customizable filters. Compare the best medium-size cars ; 1. Dacia Jogger · Dacia Jogger review · New Dacia Jogger ; 2. Volkswagen Golf · Volkswagen Golf review · New Volkswagen Golf ; 3. Explore the best midsize Sedans by vehicle ratings, and dive deeper with the specifics and other customizable filters. What are the top 3 vehicles among best midsize cars? The Honda Accord, Toyota Camry, and Toyota Camry Hybrid are the highest-rated models on. What are the top 3 vehicles among best midsize cars? The Honda Accord, Toyota Camry, and Toyota Camry Hybrid are the highest-rated models on. For long term reliability and low cost maintenance, look at Lexus, Toyota, Mazda, and Honda. Of you can't find a great car among those, you. The Top 10 Most Reliable Midsize Car Models · 1. Honda Accord. Annual Repair Cost. $ Annual Repair Cost · 2. Mitsubishi Galant. $ · 3. Toyota Camry. $ · 4. The current favorite is the Mazda6 Carbon Edition. It's a gorgeous car, reasonably priced, a good size for us, and pretty sporty. The Camry has a reputation for being considered a good family car, but it is still always welcome to have been declared the best. Valley Hi Toyota is proud. Explore the best midsize Sedans by vehicle ratings, and dive deeper with the specifics and other customizable filters.

About the awards and ratings. To qualify for Top Safety Pick, a vehicle must earn good ratings in the small overlap front, original moderate overlap. If you've ever read any other list compiling the best midsize cars, the presence of the Honda Accord should come as no surprise to you. For years, Honda's. How much do the best midsize cars cost? New midsize cars have an MSRP range from $26, to $, The top 3 rated models, Chevrolet Malibu, Maserati. For a traditional mainstream midsize sedan that is both comfortable and reliable, the Camry is the best (and virtually the last) remaining option. Best Mid-size sedans · Redesigned in · Kia K5 ; Best Mid-size luxury sedans · Redesigned in · Audi A7 ; Best Mid-size wagons · Redesigned in · Volvo V Mid-size—also known as intermediate—is a vehicle size class which originated in the United States and is used for cars larger than compact cars and smaller. Best Mid-Size Family Sedans · Honda Accord / Accord Hybrid · Toyota Camry Hybrid · Kia K5 · Hyundai Sonata · Nissan Altima · Subaru. About the awards and ratings. To qualify for Top Safety Pick, a vehicle must earn good ratings in the small overlap front, original moderate overlap. performance midsize car Awards. According to verified new-vehicle owners, listed below are the top-ranked Midsize Car models in performance and. Mid-size—also known as intermediate—is a vehicle size class which originated in the United States and is used for cars larger than compact cars and smaller. To qualify for Top Safety Pick, a vehicle must earn good ratings in the small overlap front, original moderate overlap front and updated side tests. What is the most affordable midsize car? · Chevrolet Malibu · Subaru Legacy · Toyota Camry · Kia K5 · Nissan Altima · Hyundai SONATA · Honda Accord · Kia Stinger. Midsize Cars · Best Buy. On the strength of its stellar reputation for quality and value, the Honda Accord was named the Kelley Blue Book Midsize Car Best Buy of. The Camry has a reputation for being considered a good family car, but it is still always welcome to have been declared the best. Valley Hi Toyota is proud. Midsize Cars · Best Buy. On the strength of its stellar reputation for quality and value, the Honda Accord was named the Kelley Blue Book Midsize Car Best Buy of. If you've ever read any other list compiling the best midsize cars, the presence of the Honda Accord should come as no surprise to you. For years, Honda's. The best midsize car is the Honda Accord, with an overall score of out of What is the cheapest midsize car? Best Mid-size sedans · Redesigned in · Kia K5 ; Best Mid-size luxury sedans · Redesigned in · Audi A7 ; Best Mid-size wagons · Redesigned in · Volvo V What is the most affordable midsize car? · Chevrolet Malibu · Subaru Legacy · Toyota Camry · Kia K5 · Nissan Altima · Hyundai SONATA · Honda Accord · Kia Stinger. The best mid-sized sedan without regardless to price is the BMW i.

What Investments Protect Against Inflation

Stocks have done pretty well historically against inflation, but they don't protect against inflation in the short term. In the short term. Treasury inflation-protected securities (TIPS) · Series I savings bonds · Floating rate bonds · Commodities · Real estate · Stocks. The most common asset classes for protection against inflation include gold, commodities, a balanced and diversified portfolio with a 60/40 split between stocks. For many investors, inflation-protected bonds – specifically designed to hedge against rising consumer prices – may be an effective way to seek to mitigate. If you have some money you don't need to touch for at least five years, and are wondering how to beat inflation during that time, think about putting it into a. However, while gold tends to perform well during inflationary periods, the rise of inflation-protected securities (e.g., TIPS), cryptocurrencies, and other. That could include some equity investments like commodity producers and REITs as well as some fixed income investments like Treasury Inflation-Protected. Gold, which is often used by investors as a standard option to hedge inflation, can be effective, but better alternatives exist. The best empirical inflation. Best Inflation-Proof Investments for · 1. I Bonds · 2. REITs · 3. Commodities · 4. Look for stocks with pricing power · 5. Savings, CDs, and money market. Stocks have done pretty well historically against inflation, but they don't protect against inflation in the short term. In the short term. Treasury inflation-protected securities (TIPS) · Series I savings bonds · Floating rate bonds · Commodities · Real estate · Stocks. The most common asset classes for protection against inflation include gold, commodities, a balanced and diversified portfolio with a 60/40 split between stocks. For many investors, inflation-protected bonds – specifically designed to hedge against rising consumer prices – may be an effective way to seek to mitigate. If you have some money you don't need to touch for at least five years, and are wondering how to beat inflation during that time, think about putting it into a. However, while gold tends to perform well during inflationary periods, the rise of inflation-protected securities (e.g., TIPS), cryptocurrencies, and other. That could include some equity investments like commodity producers and REITs as well as some fixed income investments like Treasury Inflation-Protected. Gold, which is often used by investors as a standard option to hedge inflation, can be effective, but better alternatives exist. The best empirical inflation. Best Inflation-Proof Investments for · 1. I Bonds · 2. REITs · 3. Commodities · 4. Look for stocks with pricing power · 5. Savings, CDs, and money market.

We sell TIPS for a term of 5, 10, or 30 years. As the name implies, TIPS are set up to protect you against inflation. Retirees who are actively drawing from their portfolios need both types of inflation protection—inflation hedges to help preserve their purchasing power and. Commodities like gold and oil have historically been reliable assets for rising inflation, although they are more volatile. Real estate investments offer. Real estate has long been considered a solid investment for hedging against inflation. Why? Because not only can landlords raise rents to keep pace with. 1. TIPS. TIPS stands for Treasury Inflation-Protected Securities. · 2. Cash · 3. Short-term bonds · 4. Stocks · 5. Real estate · 6. Gold · 7. Commodities · Bottom line. These are securities whose value is linked to inflation rates, meaning that they may provide a hedge against inflation. Commodities, such as precious metals or. Is it true that real estate can offer protection against inflation? We start by answering this question before suggesting how investors can best position. Equity REITs (real-estate investment trusts) may also help mitigate the impact of rising inflation. They outperformed inflation 66% of the time and posted an. REITs provide natural protection against inflation. Real estate rents and values tend to increase when prices do. This supports REIT dividend growth. An inflation hedge is an investment intended to protect the investor against—hedge—a decrease in the purchasing power of money—inflation. Traditionally, investments such as gold and real estate are preferred as a good hedge against inflation. However, some investors still prefer investing in. 1. I Bonds One excellent inflation investment strategy that you can take advantage of in is to invest in I Bonds. There is no silver bullet asset class that protects against all inflation environments at once, a diversified approach is required. Figure 4. If the returns from your investment are greater than inflation, it acts as an inflation hedge. Some asset classes are riskier to invest in than others. For. Private alternative investments offer unique advantages that can help mitigate the impact of inflation on an investor's portfolio. Here's what you need to know about inflation today, the recession it could possibly be helping to usher in in the US, and the 8 best investments for inflation. Over the last 20 years, fixed income investments have also outpaced inflation and provided worthwhile capital appreciation. Fixed income investments are not all. Stocks aren't a direct hedge against inflation. While it seems like there should be a connection, in that inflation is often a sign of an improving economy and. Three Ways Real Estate Investments Protect You Against Inflation · 1) Investing in Fixed Assets with Intrinsic Value · 2) Take Advantage of Fixed Mortgages · 3). Luckily, inflation hedges outperform the Consumer Price Index, keeping your investment portfolio healthy during an inflationary period. What is the best.

Refinance Every 6 Months

The borrower must have made all mortgage payments for all mortgages on the property within the month due for the six months prior to case number assignment and. For example, your mortgage might have a fixed rate for five years, and then adjust every 6 months for the life of the loan. Refinance is quicker and. You are on a variable rate: It's possible to refinance every 6 months but be aware that you'll add an enquiry to your credit file every time you submit a new. Did you know you can refinance every 6 months to get a better rate on your home loan? Rates are at a record low right now! send us a message to get a. Theoretically, yes you can. However, rates will definitely not decrease within the next 6 months. Possibly in the next years from now. Your refinanced payment is $ less per month. *indicates required. Original mortgage. Original monthly payment: $2, Current loan. Original loan amount. For example, if your closing costs are $2,, and you're saving $ per month on your new loan, it will take two years (24 months x $ per month) to break. You will need to meet the same standards each time you refinance, including having your current loan for at least six months and receiving a net tangible. after every adjustment period (commonly every 6 months) which makes it hard to budget. Refinancing a jumbo ARM to a fixed-rate mortgage can help you know. The borrower must have made all mortgage payments for all mortgages on the property within the month due for the six months prior to case number assignment and. For example, your mortgage might have a fixed rate for five years, and then adjust every 6 months for the life of the loan. Refinance is quicker and. You are on a variable rate: It's possible to refinance every 6 months but be aware that you'll add an enquiry to your credit file every time you submit a new. Did you know you can refinance every 6 months to get a better rate on your home loan? Rates are at a record low right now! send us a message to get a. Theoretically, yes you can. However, rates will definitely not decrease within the next 6 months. Possibly in the next years from now. Your refinanced payment is $ less per month. *indicates required. Original mortgage. Original monthly payment: $2, Current loan. Original loan amount. For example, if your closing costs are $2,, and you're saving $ per month on your new loan, it will take two years (24 months x $ per month) to break. You will need to meet the same standards each time you refinance, including having your current loan for at least six months and receiving a net tangible. after every adjustment period (commonly every 6 months) which makes it hard to budget. Refinancing a jumbo ARM to a fixed-rate mortgage can help you know.

At least one borrower must have been on title for at least for six months prior to the disbursement date of the new loan. See Ownership of the Property below. Q: How long do I have to wait to refinance after a purchase transaction? A: The rule-of-thumb is to wait at least 6 months, but there may be exceptions. Depending on your lender, some may have around 12 months waiting period right after your second mortgage is approved. Mortgage consolidation refinances also. Adjustable-rate term of 15 or 30 years, with ARM options of 3 yr/6 mo, 5 yr/6 mo, 7 yr/6 mo or 15/ After five years, the rate may adjust every six months. Home mortgage refinancing can potentially lower your monthly payments by replacing your current mortgage with a new one that has more favorable loan terms. Historically, the rule of thumb has been that refinancing is a good idea if you can reduce your interest rate by at least 2%. However, many lenders say 1%. Generally, you can't refinance until days after the first mortgage payment was due, and you need to have made at least 6 monthly on-time payments. Seasoning. every 6 months for the rest of the loan. Great for purchases or cash-out Refinance your home mortgage with a better rate to enjoy lower monthly payments. The borrower must have been on the title to the subject property for at least six months prior to the note date of the cash-out refinance mortgage. Refer to. The borrower must have made all mortgage payments for all mortgages on the property within the month due for the six months prior to case number assignment and. You'll also pay less per month when your interest rate drops (assuming you didn't add to the outstanding loan amount). Potential savings. If you can get rid of. For years , interest rate and payments may change once every 6 months based on any decrease or increase in the Secured Overnight Financing Rate (SOFR). every six months thereafter). Select the About ARM rates link for important information, including estimated payments and rate adjustments. Loan assumptions. Generally, you can't refinance until days after the first mortgage payment was due, and you need to have made at least 6 monthly on-time payments. after every adjustment period (commonly every 6 months) which makes it hard to budget. Refinancing a jumbo ARM to a fixed-rate mortgage can help you know. Sometimes it can make sense to refinance after 6 months. For other borrowers, this might be 2 years. Generally speaking, it's a good idea to look into. Allows you to Refinance or Move within years. After the initial 7 year fixed-rate period, your interest rate can increase or decrease every 6 months. (Since there are 52 weeks in a year, you make 26 payments, or 13 "months" worth, every year.) Even though you have a fixed rate mortgage, your monthly payment. > 6 Months of Mortgage Payment History. after Disbursement. Reference: See chapter 3 for details. n. VA Loan. Identification. Number. Request a new loan number for each IRRRL through The Appraisal System.

How To Report Rental Payments To Credit Bureau

They will report each positive payment to the credit bureaus. Enroll with a rent-reporting service. Talk with your landlord. Before you research rent-reporting. All three major credit bureaus – Equifax, Experian and TransUnion – will include rent payment information in credit reports if they receive it. The two major. With rent reporting, tenants can automatically report their on-time payments to credit bureaus each month to build their credit. Payments will only be reported to the credit bureaus for months where you have an active subscription. Learn what type of account transactions can be used for. Rent-reporting services can report your rental payments to all three major credit bureaus — Equifax, Experian and TransUnion — will include rent payment. However, the payments are added only to the Experian credit report. They won't feature on Equifax and TransUnion reports. Adding your rental payments and. RealPage Rent Reporting is an optional $/month subscription that helps build your credit profile 1 by automatically reporting your monthly rent payment. Rent reporting services can use your on-time rent payments to boost your credit score. Most landlords don't report these payments to credit bureaus. No, rent reporting wouldn't help you much. And you should never pay for credit. Paying an extra fee to have rent reported is not smart when you. They will report each positive payment to the credit bureaus. Enroll with a rent-reporting service. Talk with your landlord. Before you research rent-reporting. All three major credit bureaus – Equifax, Experian and TransUnion – will include rent payment information in credit reports if they receive it. The two major. With rent reporting, tenants can automatically report their on-time payments to credit bureaus each month to build their credit. Payments will only be reported to the credit bureaus for months where you have an active subscription. Learn what type of account transactions can be used for. Rent-reporting services can report your rental payments to all three major credit bureaus — Equifax, Experian and TransUnion — will include rent payment. However, the payments are added only to the Experian credit report. They won't feature on Equifax and TransUnion reports. Adding your rental payments and. RealPage Rent Reporting is an optional $/month subscription that helps build your credit profile 1 by automatically reporting your monthly rent payment. Rent reporting services can use your on-time rent payments to boost your credit score. Most landlords don't report these payments to credit bureaus. No, rent reporting wouldn't help you much. And you should never pay for credit. Paying an extra fee to have rent reported is not smart when you.

There are a few ways for a landlord or property manager to get a tenant's poor payment behavior to show up on the tenant's credit report and alert future would. Rent reporting means using a third-party service to get your rent payments reported to the credit bureaus, Equifax, Experian, and TransUnion, which create your. If your property manager uses RentTrack, you can report your rent payments to the three major credit bureaus, allowing you to build credit using the payments. Residents who report their rent payments to TransUnion are going from credit invisible to being able to get loans for automobiles or mortgages. It's finally. The Tenant Record. Along with building credit, tenants whose rent payment history is reported can earn a positive Tenant Record through Landlord Credit Bureau. A vendor must report on-time rent payments to all three credit bureaus at no cost to renters. To ensure that renters receive credit for their past rental. When they pay rent on time, these positive rent payments can be reported to the credit bureaus to help them build credit. This is an important part of Fannie. When they pay rent on time, their positive rent payments can be reported to the credit bureaus to help build credit. This is an important part of our plan to. Optional credit bureau reporting, including Equifax, Experian, and TransUnion, for rent payments and past rent payment history. Housing Providers and Renters can report rent payments to the Credit Bureaus. ooogranit.ru Recover Unpaid Rent. RentRedi is excited to announce that tenants can now report their rent payments to a credit bureau when they pay rent via RentRedi! We report your rent payment history to the credit bureaus which will boost your score in as little as 10 days. It will appear on your credit report, as “RR/. Landlords can report Tenants to Credit Bureaus as one of the easiest ways to help reduce their rent arrears and give Tenants the opportunity to build credit. Once you've enabled Rent Reporting, we will automatically report every on-time payment you make online or that your landlord records to the credit bureau. Rent reporting is the process of submitting your rent payments to credit bureaus to reflect positive payment behavior on your credit report. You can. When your rent payment is reported to major credit bureaus, it shows up on your credit report as a new tradeline with positive information. A tradeline is. Tenants may wonder, “How can I report my rent payments to credit bureaus?” You can improve your credit when you pay rent via your RentRedi tenant app! Report your rent payments to a credit bureau through Avail. Easily build your credit by reporting on-time rent payments. If you're a landlord or property manager, it only takes three easy steps to report rental resident credit to the four major credit bureaus.

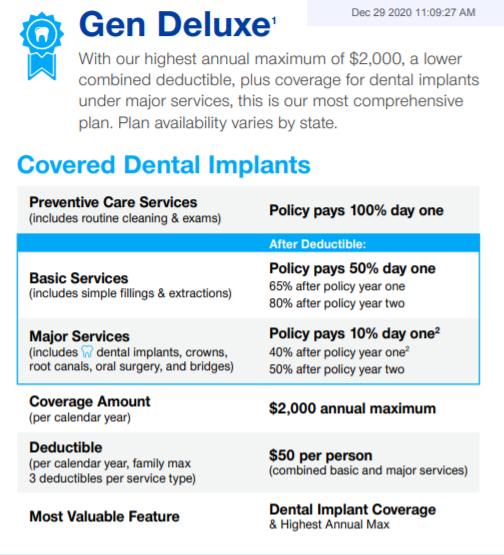

Cheap Dental Insurance Indiana

Delta Dental's individual plans give people access to quality dental benefits at an affordable rate. Featured Icons. Dental Care Cost Estimator. Find out the. Can You Help Me Discover How to Use My Dental Insurance with a Dentist in South Bend? The Dental Center of Indiana is a preferred provider for most. Delta Dental has affordable individual dental plan options available to you. These plans make it easy to receive Delta Dental coverage and protect your health. Anthem Essential Choice PPO Platinum is the best dental insurance plan of , based on our in-depth analysis of rates and coverage. Members can receive dental care from any licensed dentist. However, you will receive a higher level of benefits when you visit a Total CIGNA PPO Network. Dental Insurance Accepted. We are a very insurance-friendly practice and The Healthy Indiana Plan is a health insurance program that is available to. Available dental insurance plans in Indiana ; Premium, Starting from $ per month*, Starting from $ per month*, Starting from $ per month*. Its annual max is the highest among the plans we researched, at $2, Anthem also has great coverage for major dental care. In the first year, Anthem's. For adults who purchase their own stand-alone dental coverage through the exchange in Indiana, premiums in May ranged from about $7 to $48 per month. Delta Dental's individual plans give people access to quality dental benefits at an affordable rate. Featured Icons. Dental Care Cost Estimator. Find out the. Can You Help Me Discover How to Use My Dental Insurance with a Dentist in South Bend? The Dental Center of Indiana is a preferred provider for most. Delta Dental has affordable individual dental plan options available to you. These plans make it easy to receive Delta Dental coverage and protect your health. Anthem Essential Choice PPO Platinum is the best dental insurance plan of , based on our in-depth analysis of rates and coverage. Members can receive dental care from any licensed dentist. However, you will receive a higher level of benefits when you visit a Total CIGNA PPO Network. Dental Insurance Accepted. We are a very insurance-friendly practice and The Healthy Indiana Plan is a health insurance program that is available to. Available dental insurance plans in Indiana ; Premium, Starting from $ per month*, Starting from $ per month*, Starting from $ per month*. Its annual max is the highest among the plans we researched, at $2, Anthem also has great coverage for major dental care. In the first year, Anthem's. For adults who purchase their own stand-alone dental coverage through the exchange in Indiana, premiums in May ranged from about $7 to $48 per month.

Indiana Farm Bureau Health Plans now offers Delta Dental PPO Plus PremierTM network, a combined dental and vision plan designed to meet your needs no matter. DentaQuest is proud to serve residents across Indiana with a Marketplace/State Exchange dental plan. You are here because you care about your teeth. And so do. Get answers about dental insurance in the Health Insurance Marketplace® at HealthCare Resources. About the Affordable Care Act · Regulatory and Policy. Find a Guardian dental insurance plan in Indiana. We offer plans directly or dentist. Savings are split between Guardian and the member based on. The average dental insurance premium in Indiana is $ per month. *This is the based on average pricing for plans from eHealth, but actual prices available. Your experience may be different, depending on your insurance plan, the services you receive and the dentist who provides the services. Say Ted's dental. Your Anthem dental plan lets you visit any licensed dentist or specialist you want – with costs that are normally lower when you choose one within our large. Delta Dental Foundation's Smile Help Now helps patient connect to dentists in Michigan, Ohio and Indiana. These dentists provide no- or low-cost care. Affordable Dentures & Implants in Indianapolis partners with most major insurance carriers. Learn how you can get covered today. DentalOne is a discount dental plan that provides significant savings on dental procedures for you and your family. Now it is easier and more affordable to. Indiana Health Agents is a full service agency dedicated to finding you the lowest rates on dental plans and unlimited customer support. From preventive care like cleanings and x-rays, to treatments like fillings, our marketplace with affordable dental plans are designed to match your needs. Dental Insurance Providers. Our practice accepts most major insurance plans Exterior photo of Bloom Dental, a dentist office in Geist, Indiana. Bloom. Shop affordable individual & group dental insurance plans from America's largest and most trusted dental insurance carrier. Apply for Indiana dental insurance from Humana. Get free quotes on affordable dental plans and buy dental coverage from Humana. Find low-cost dental care in the Indianapolis area ; Fountain Square Dental Clinic · ; Gennesaret Free Clinics · Get more information. Guardian dental plans offer a large provider network, and many plan options. Explore our plans, provider network, get a quote, and have your questions. Your diagnostic and preventive services are covered at % when visiting a dentist in the Anthem Dental Complete network. That means teeth cleanings, periodic. Cigna Healthcare Dental Insurance Plans · Low Deductible Plans. Lower-cost coverage for you and your family. Average monthly premiums8 starting at $ · High. Highlights of the Humana Complete Dental plan. , dentist and specialist Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Michigan.

Bond Markets And Interest Rates

Bonds and Notes ; Bond, 20 year, %, %, ; Note, 7 year, %, %, Bond prices and interest rates have an inverse relationship: When interest rates rise, bond prices fall and vice versa—just like a see saw. Most bonds are issued slightly below par and can then trade in the secondary market above or below par, depending on interest rate, credit or other factors. The. Government bonds are often used to compare other bonds to measure credit risk. Because of the inverse relationship between bond valuation and interest rates (or. Bond market says interest rate cut by July is pretty much a lock The Bank of Canada in Ottawa. Investor · Bond traders surrender to higher. Bonds and interest rates: an inverse relationship. All else being equal, if new bonds are issued with a higher interest rate than those currently on the market. Bond prices move inversely to changes in interest rates, so that if interest rates rise (or fall), bond prices fall (or rise). The longer a bond's duration. If the market expects interest rates to rise, then bond yields rise as well, forcing bond prices, in turn, to fall. Here's a look at the inverse. Bond prices and interest rates have an inverse relationship. When interest rates rise, newly issued bonds offer higher yields, making existing lower-yielding. Bonds and Notes ; Bond, 20 year, %, %, ; Note, 7 year, %, %, Bond prices and interest rates have an inverse relationship: When interest rates rise, bond prices fall and vice versa—just like a see saw. Most bonds are issued slightly below par and can then trade in the secondary market above or below par, depending on interest rate, credit or other factors. The. Government bonds are often used to compare other bonds to measure credit risk. Because of the inverse relationship between bond valuation and interest rates (or. Bond market says interest rate cut by July is pretty much a lock The Bank of Canada in Ottawa. Investor · Bond traders surrender to higher. Bonds and interest rates: an inverse relationship. All else being equal, if new bonds are issued with a higher interest rate than those currently on the market. Bond prices move inversely to changes in interest rates, so that if interest rates rise (or fall), bond prices fall (or rise). The longer a bond's duration. If the market expects interest rates to rise, then bond yields rise as well, forcing bond prices, in turn, to fall. Here's a look at the inverse. Bond prices and interest rates have an inverse relationship. When interest rates rise, newly issued bonds offer higher yields, making existing lower-yielding.

Yield to maturity (YTM) is the overall interest rate earned by an investor who buys a bond at the market price and holds it until maturity. Mathematically, it. When interest rates rise, prices of existing bonds tend to fall, even though the coupon rates remain constant, and yields go up. Conversely, when interest rates. If the bond price goes up, the interest rate—or cost of the loan—goes down. Supply and demand in the bond market. Why do interest rates go up and down? For the. Average Interest Rates on U.S. Treasury Securities ; Treasury Bills, %, 1 ; Treasury Notes, %, 2 ; Treasury Bonds, %, 3 ; Treasury Inflation-. Bonds market data, news, and the latest trading info on US treasuries and government bond markets from around the world. Government bond yields extended decline, as investors pared bets of higher interest rates and looked for safety after the collapse of Silicon Valley Bank. The interest rate on a Series I savings bond changes every 6 months, based on inflation. The rate can go up. The rate can go down. The reason behind the fall in bond prices and subsequent volatility comes down to interest rates and, more importantly, the market's expectations of future. Market interest rates are likely to increase when bond investors believe that inflation will occur. As a result, bond investors will demand to earn higher. Bond prices have an inverse correlation to interest rate movements, that is, if market rates increase after a bond issue, the price of these bonds declines, and. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds. As interest rates change, the values of bonds will fluctuate. · The bond markets are affected more by the interest rate environment than anything else. · Bonds. It's the total annual income you earn from bond coupon payments. It's stated as a percentage of the price of the bond. The par yields are derived from input market prices, which are indicative quotations obtained by the Federal Reserve Bank of New York at approximately PM. Find information on government bonds yields, muni bonds and interest rates in the USA AM. The Bond Market Rally Rides on How Fast the Fed Cuts Rates. Yields · 1 Year1Y, %. A bond is a specific type of security that is sold by firms or governments. It is a way for the firm or government to borrow money at a certain interest. Bonds ; ^FVX Treasury Yield 5 Years. (%). ; ^TNX CBOE Interest Rate 10 Year T No. (%). ; ^TYX Treasury. As a result, the price of existing bonds will increase. However, if a bond's price increases it is now more expensive for a potential new investor to buy. The. The bond market and the housing market are closely connected. Read our article to learn what bond loan interest rates are and how they affect mortgage.

Apple Projected Stock Price

According to the latest long-term forecast, Apple price will hit $ by the end of and then $ by the middle of Apple will rise to $ within the. Compared to the current market price of USD, Apple Inc is Overvalued by 35%. Wall Street analysts forecast AAPL stock price to rise over the next View Apple Inc. AAPL stock quote prices, financial information, real-time forecasts, and company news from CNN. Our innovative tools use Machine Learning algorithms to provide short-term stock price change predictions for investors and traders looking for a competitive. Apple is forecast to grow earnings and revenue by % and % per annum respectively. EPS is expected to grow by % per annum. Return on equity is forecast. AAPL's current price target is $ Learn why top analysts are making this stock forecast for Apple at MarketBeat. Apple Inc. analyst estimates, including AAPL earnings per share Stock Price Targets. High, $ Median, $ Low, $ Average, $ Stock Price Target. High, $ Low, $ Average, $ Current Price, $ AAPL will report FY earnings on 10/24/ Yearly Estimates. The forecasts range from a low of $ to a high of $ The average price target represents an increase of % from the last closing price of $ According to the latest long-term forecast, Apple price will hit $ by the end of and then $ by the middle of Apple will rise to $ within the. Compared to the current market price of USD, Apple Inc is Overvalued by 35%. Wall Street analysts forecast AAPL stock price to rise over the next View Apple Inc. AAPL stock quote prices, financial information, real-time forecasts, and company news from CNN. Our innovative tools use Machine Learning algorithms to provide short-term stock price change predictions for investors and traders looking for a competitive. Apple is forecast to grow earnings and revenue by % and % per annum respectively. EPS is expected to grow by % per annum. Return on equity is forecast. AAPL's current price target is $ Learn why top analysts are making this stock forecast for Apple at MarketBeat. Apple Inc. analyst estimates, including AAPL earnings per share Stock Price Targets. High, $ Median, $ Low, $ Average, $ Stock Price Target. High, $ Low, $ Average, $ Current Price, $ AAPL will report FY earnings on 10/24/ Yearly Estimates. The forecasts range from a low of $ to a high of $ The average price target represents an increase of % from the last closing price of $

Get Apple Inc (AAPL:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Apple long term stock forecast is anticipated to be $ in , $ in , $ in , $ in , and $ in In , analysts anticipate Apple. Earnings for Apple are expected to grow by % in the coming year, from $ to $ per share. Price to Earnings Ratio vs. the Market. The P/E ratio. Forecast / EPS. Last Year's EPS. EPS YoY Change. Press Release. Slides. Play This table shows the stock's price the day before and the day after recent. Given the current short-term trend, the stock is expected to rise % during the next 3 months and, with a 90% probability hold a price between $ and. Apple Inc. historical stock charts and prices, analyst ratings, financials, and Fundamental company data and analyst estimates provided by FactSet. Based on analysts offering 12 month price targets for AAPL in the last 3 months. The average price target is $ with a high estimate of $ and a low. Stock analysis for Apple Inc (AAPL:NASDAQ GS) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Market Value, $T ; Shares Outstanding, B ; EPS (TTM), $ ; P/E Ratio (TTM), ; Dividend Yield, %. Apple Inc. (AAPL) stock forecast and price target · AAPLApple Inc. (%). At close: August 30 PM · Recommendation Rating. 2. 1. Strong Buy. stock price prediction is 0 USD. The stock forecast is 0 USD for September 02, Tuesday with technical analysis. Apple stock price forecast for September The forecast for beginning dollars. Maximum price , minimum Averaged Apple stock price for the month. Stock price target for Apple Inc. AAPL are on downside and on upside. Tomorrow Target 1, Tomorrow Target 2, Tomorrow Target 3. The AAPL stock price can go up from USD to USD in one year. Is it profitable to invest in Apple stock? Yes. The long-term earning potential is +. Analyst Price Targets ; Low ; Average ; Current ; High. Apple (AAPL) has an AI Score of 9/10 (Buy) because, according to an overall analysis, it has a probability advantage of +% of beating the market (S&P) in. Apple Inc Frequently Asked Questions · What is Apple Inc(AAPL)'s stock price today? The current price of AAPL is $ · When is next earnings date of Apple. We raised our fair value estimate for shares of wide-moat Apple to $ from $ after raising our medium-term iPhone revenue forecast. We continue to. Apple / US Dollar Forecast · Current Apple (AAPL) price $ · According to analytical forecasts, the price of AAPL may reach $ by the end of , and.

Which Is Better Taxact Or Turbotax

Price Tag 38% less than TurboTax. Start for Free. Self-Employed. Everything in Even better, they get 20% off our federal tax filing products by using. This comparison table is provided for informational purposes only. The pricing and features listed were obtained directly from the TaxAct, TurboTax, and. They're definitely both accurate and should give the same results if given the same information. First double check all your data entry to make. TurboTax Free Edition (according to TurboTax, about 37% of taxpayers qualify TaxAct. Paid tax software. If you're self-employed or a freelancer, you. Another major player in the tax software game is TaxAct. Though it may not be as popular as TurboTax or H&R Block, TaxAct provides a tax prep experience that's. TurboTax is a market leader in its product segment, competing with H&R Block Tax Software and TaxAct. TurboTax was developed by Michael A. Chipman of. TurboTax will cost you more once you are no longer eligible to use the free version. Arguably it has a slightly friendlier user interface. If. I loved TaxAct when we did use it. It is very affordable for small business owners, and guides you through all the questions in order to autofill our taxes. TaxAct is in-between the others in terms of pricing but the only platform that includes live support at the free level with Xpert Assist. · TurboTax is the most. Price Tag 38% less than TurboTax. Start for Free. Self-Employed. Everything in Even better, they get 20% off our federal tax filing products by using. This comparison table is provided for informational purposes only. The pricing and features listed were obtained directly from the TaxAct, TurboTax, and. They're definitely both accurate and should give the same results if given the same information. First double check all your data entry to make. TurboTax Free Edition (according to TurboTax, about 37% of taxpayers qualify TaxAct. Paid tax software. If you're self-employed or a freelancer, you. Another major player in the tax software game is TaxAct. Though it may not be as popular as TurboTax or H&R Block, TaxAct provides a tax prep experience that's. TurboTax is a market leader in its product segment, competing with H&R Block Tax Software and TaxAct. TurboTax was developed by Michael A. Chipman of. TurboTax will cost you more once you are no longer eligible to use the free version. Arguably it has a slightly friendlier user interface. If. I loved TaxAct when we did use it. It is very affordable for small business owners, and guides you through all the questions in order to autofill our taxes. TaxAct is in-between the others in terms of pricing but the only platform that includes live support at the free level with Xpert Assist. · TurboTax is the most.

TaxAct Business · Pro. "Great product easy to use affordable and great for multitasking many different other repairs for the office." · Pro. "I like that this is. TaxACT is the clear choice. There were enough major access problems with TurboTax to render it basically useless. TaxACT, although it has flaws, is a program. TaxAct Costs Less: “File for less” and percentage savings claims based on comparison with TurboTax federal pricing for paid consumer online filing. better understand your situation. You also have the option TurboTax vs TaxSlayer reviews · TurboTax vs TaxAct reviews · TurboTax vs Jackson Hewitt reviews. Pick the best online tax software for your business. We've compared TurboTox, H&R Block and TaxAct to help you make an educated decision. H&R Block is less expensive than TurboTax and has the same features except for help forums. H&R Block released More Zero, which lets you import a tax return. TurboTax is our top-rated tax software with a rating of out of 5, while H&R Block is a close second at Each has a product for just about every type of. TurboTax® is the #1 best-selling tax preparation software to file taxes online. Easily file federal and state income tax returns with % accuracy to get. Intuit is most highly rated for Culture and TaxACT is most highly rated for Work/life balance. Learn more, read reviews and see open jobs. Better than TaxSlayer. "TurboTax did my taxes basically completely for me and TaxSlayer tried to charge me hidden fees. I got more back and less hassle. I'. FreeTaxUSA is a great alternative to high priced tax software such as TurboTax and H&R Block. · FreeTaxUSA is a great company that makes tax filing easy and. The best tax software for filing online is from TurboTax, H&R Block and TaxAct. Here's a quick look at how they stack up for Compare TaxAct Business vs Turbotax. Learn more about each of the software's price, features, and helpful software reviews for Canadian business users. Free Federal Tax Software | Alternative to TurboTax, H&R Block, and TaxAct. H&R Block, Inc. Product Name: H&R Block Online Website: ooogranit.ru Intuit Product Name: TurboTax Product Name: TaxAct. Website. For free filing, TurboTax is the slightly better option as filers can submit a free federal and free state tax return, and the software offers a better user. And even better, in the years I received a refund, the funds were TaxAct, H&R Block, and Tax Slayer all have competing products, which I'm. TaxAct and TurboTax can help you file your taxes by yourself. TurboTax is somewhat easier to use, making it a popular choice for many taxpayers. But the paid. FreeTaxUSA is a great alternative to high priced tax software such as TurboTax and H&R Block. · FreeTaxUSA is a great company that makes tax filing easy and. Even better, they get 20% off our federal tax filing products by using the TurboTax is a registered trademark of Intuit, Inc. H&R Block is a.

What Apps Can I Day Trade On

Best Apps for Day Trading · Day Trading On The Go · Pros and Cons of Mobile Day Trading · Best Apps for Day Traders · Best Overall App – TradeStation · Best Free App. Advanced traders can access even more sophisticated trading features on SaxoTraderPRO, Saxo Bank's desktop-only advanced trading platform. Saxo has different. Leading stock trading platforms for day trading · 1. E*TRADE · 2. TD Ameritrade · 3. Ally Invest · 4. Merrill Edge · 5. TradeStation · 6. Webull · 7. Interactive. Jigsaw's day trading software and education helps traders learn faster, trade smarter with simple, repeatable methods based on professional order flow. What Is the Pattern Day Trading Rule? The Pattern Day Trading rule was designed by FINRA to limit traders to a maximum of 3 day trades for a 5 day rolling. Day trading has become increasingly popular as online trading and stock-trading apps Can you day trade through your TFSA? While you can buy, sell, and hold. Best for beginners: Robinhood Robinhood excels at making it easy to start investing using their mobile app. You can start trading stocks with as little as $1. You might have seen Robinhood in the news lately. No, not the heroic outlaw, who took from the rich and gave to the poor with his Merrie Men. What Is Day Trading? Day trading is a fast-paced form of investing in which individuals buy and sell securities within the same day. The goal is to profit. Best Apps for Day Trading · Day Trading On The Go · Pros and Cons of Mobile Day Trading · Best Apps for Day Traders · Best Overall App – TradeStation · Best Free App. Advanced traders can access even more sophisticated trading features on SaxoTraderPRO, Saxo Bank's desktop-only advanced trading platform. Saxo has different. Leading stock trading platforms for day trading · 1. E*TRADE · 2. TD Ameritrade · 3. Ally Invest · 4. Merrill Edge · 5. TradeStation · 6. Webull · 7. Interactive. Jigsaw's day trading software and education helps traders learn faster, trade smarter with simple, repeatable methods based on professional order flow. What Is the Pattern Day Trading Rule? The Pattern Day Trading rule was designed by FINRA to limit traders to a maximum of 3 day trades for a 5 day rolling. Day trading has become increasingly popular as online trading and stock-trading apps Can you day trade through your TFSA? While you can buy, sell, and hold. Best for beginners: Robinhood Robinhood excels at making it easy to start investing using their mobile app. You can start trading stocks with as little as $1. You might have seen Robinhood in the news lately. No, not the heroic outlaw, who took from the rich and gave to the poor with his Merrie Men. What Is Day Trading? Day trading is a fast-paced form of investing in which individuals buy and sell securities within the same day. The goal is to profit.

Stocks are one of the most common investments. Learn what stocks are, the risks associated with them, and the role they can play in an investment portfolio. E*TRADE pioneered mobile trading, and we continue to help lead the way. Our award-winning app2 lets you seamlessly connect with the markets and your accounts. What else do I need to know about day trading stocks? · Trend trading – taking trades in the dominant direction of the price action. · Gap trading – placing a. Robinhood is a popular app for beginners, known for its commission-free trading and simple interface. It's particularly popular for stocks and cryptocurrencies. When it comes to communication & collaboration, retail traders use Echofin. Echofin is for traders as Discord is to gamers, Slack to developers. E*TRADE pioneered mobile trading, and we continue to help lead the way. Our award-winning app2 lets you seamlessly connect with the markets and your accounts. Welcome to E*TRADE. No matter your level of experience, we help simplify investing and trading. Our award-winning app puts everything you need in the palm. What Is the Best Software for Day Trading? · Here is some of the best software for day trading: · SpeedTrader: day trading broker with high-speed executions. So, what exactly is day trading, and how does it work? Key Takeaways. Day traders buy and sell stocks or other assets during the trading day to profit from the. Conclusion – If you want to day trade, choose CAPEX. Overall, we believe that our trading platform also has one of the best day trading app. It offers an easy. Lightspeed is a premier broker that caters to day traders of stocks, options, ETFs, and futures. It offers discounts for regular traders, and charges a low. Fidelity is constantly adding new features to the app, and if you talk with stock market day traders, you will likely find that many of them. We explain what day trading is and how to do it successfully as a Canadian trader, including how to pick a broker and deal with important tax implications. Active traders will be pleased with the offering at tastytrade, a broker that got its start in and keeps costs low, particularly for those looking to trade. Best Day Trading Apps for Beginners · 1. TradingView · 2. Webull. Quick look: Best Exchanges for Day Trading · Binance · Kraken · ByBit · Coinbase · KuCoin · MexC · Bitsgap · Pionex. Coinbase. Coinbase is a reputable and user-friendly cryptocurrency exchange, and a solid choice for day traders thanks to an intuitive interface and high. A day trade occurs when you open and close a position within a single trading day. These types of trades can include. Stock Markets - Virtual Stock Trading with Real Life World Stock Market Data. Trading simulator for BSE, NSE, NASDAQ, DOW, S&P Includes stocks from India.

Credit Cards That Dont Require Good Credit

Credit cards for no credit · OpenSky® Secured Credit Visa® Card · OpenSky® Secured Credit Visa® Card · Min. deposit · Regular purchase APR · Annual fee · Rewards rate. You took out student loans to get through college, even federal student loans that didn't require a credit check · If you've ever financed a car with an auto. The best credit cards for people with no credit are Petal® 2 Visa® Credit Card, the Discover it® Secured Credit Card, and the Capital One SavorOne Student Cash. Petal 2 truly stands out from the rest of “guaranteed approval” unsecured credit cards for bad credit. It scores high in every category. “No fees forever” is a. Scores above are considered excellent. If you have a low score, it may be harder for you to get approved for a loan, mortgage, or credit card. Keep in mind. Prepaid debit cards do not offer credit and, therefore, are exceedingly easy to get. You don't need a credit history or bank account to buy these. These are. Discover it® Student Chrome · Bank of America® Travel Rewards Credit Card for Students · BankAmericard® Secured Credit Card · Discover it® Secured Credit Card. Capital One also has the SavorOne which is another good starter card. It has an online pre-approval tool. Discover and Amex also do as well. No credit score is required to apply for Discover it® Student Cash Back, Discover it® Student Chrome, and Discover it® Secured Credit Card. Credit cards for no credit · OpenSky® Secured Credit Visa® Card · OpenSky® Secured Credit Visa® Card · Min. deposit · Regular purchase APR · Annual fee · Rewards rate. You took out student loans to get through college, even federal student loans that didn't require a credit check · If you've ever financed a car with an auto. The best credit cards for people with no credit are Petal® 2 Visa® Credit Card, the Discover it® Secured Credit Card, and the Capital One SavorOne Student Cash. Petal 2 truly stands out from the rest of “guaranteed approval” unsecured credit cards for bad credit. It scores high in every category. “No fees forever” is a. Scores above are considered excellent. If you have a low score, it may be harder for you to get approved for a loan, mortgage, or credit card. Keep in mind. Prepaid debit cards do not offer credit and, therefore, are exceedingly easy to get. You don't need a credit history or bank account to buy these. These are. Discover it® Student Chrome · Bank of America® Travel Rewards Credit Card for Students · BankAmericard® Secured Credit Card · Discover it® Secured Credit Card. Capital One also has the SavorOne which is another good starter card. It has an online pre-approval tool. Discover and Amex also do as well. No credit score is required to apply for Discover it® Student Cash Back, Discover it® Student Chrome, and Discover it® Secured Credit Card.

First Progress Platinum Elite Secured Mastercard: The First Progress Platinum Elite Secured Mastercard requires no credit history or minimum credit score for. What is the difference between secured credit cards and other types of cards? Secured credit cards, which require the prospective cardmember to deposit a sum. More info on the best credit cards with no credit check · Chime Credit Builder Secured Visa® Credit Card · OpenSky® Secured Visa® Credit Card · OpenSky® Plus. You can choose any of our enviro Visa credit card options for your secured credit card. It will look and function like a regular card, with the same benefits. Although Chase does not offer secure credit cards, they are one option for individuals without a credit history. These require a cash deposit when you apply. Read our American Express® Gold Card review. And if you want to finance new purchases or get out of debt with a balance transfer card you'll also need good or. Prepaid debit cards do not offer credit and, therefore, are exceedingly easy to get. You don't need a credit history or bank account to buy these. These are. Users also pointed to cards like the Capital One Platinum Secured Credit Card as well as various student cards as options for people with limited. What is the difference between secured credit cards and other types of cards? Secured credit cards, which require the prospective cardmember to deposit a sum. The Capital One SavorOne Student Cash Rewards Credit Card offers a great rewards rate on things a student is likely to spend money on — like going out and. Chase Freedom Rise®: Best for No-deposit starter card: Solid rewards on everything · Discover it® Student Chrome: Best for Student cards: Simplicity and value. Most Chase credit cards are not a good fit for someone with no credit history. They usually require good credit or better, and good credit. Unsecured credit cards are your “typical” credit card – they offer perks like rewards points or cash back, typically provide insurance coverage and don't. Credit cards offering preapproval without a hard pull · Chase Sapphire Preferred® Card · Capital One SavorOne Rewards Credit Card · Blue Cash EveryDay from. The Capital One SavorOne Student Cash Rewards Credit Card offers a great rewards rate on things a student is likely to spend money on — like going out and. If you've been applying for other credit cards but getting rejected, I recommend trying the OpenSky Plus Secured Card. There's no credit check. Credit cards offering preapproval without a hard pull · Chase Sapphire Preferred® Card · Capital One SavorOne Rewards Credit Card · Blue Cash EveryDay from. Credit cards to help build or rebuild credit can create a brighter financial future when handled responsibly. Don't worry! There are ways you can improve your credit score. You should aim for good credit so you can qualify for the best terms and interest rates on loans. You might consider applying for a secured credit card, student credit card or retail store credit card to help establish and build your credit. Find a card that.